Introduction to Tattvam main

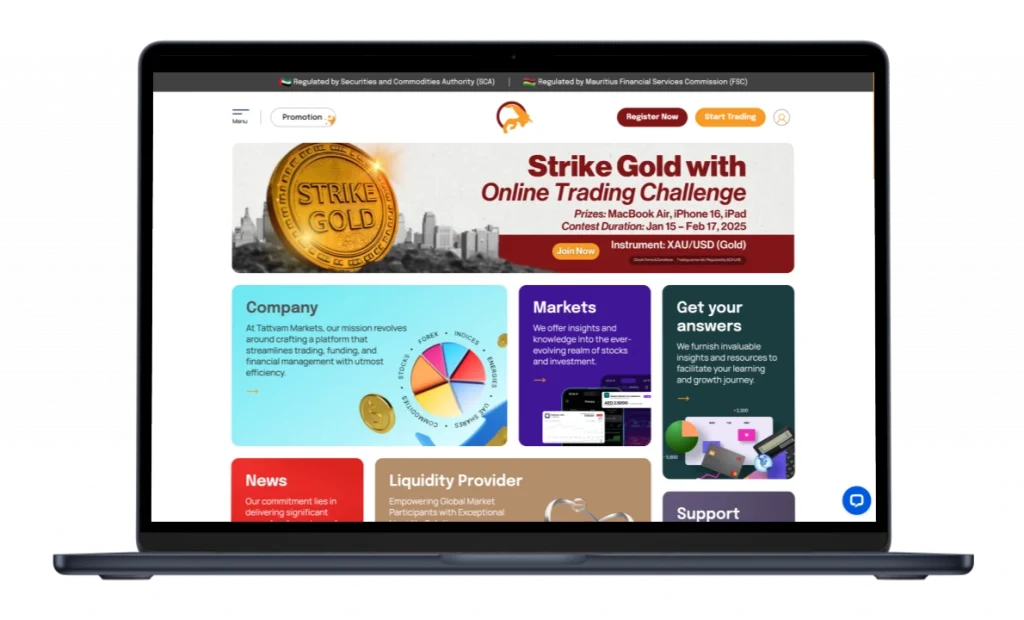

In the ever-evolving world of finance, Tattvam main has emerged as a significant player, offering a range of services that cater to both novice and experienced investors. The brand Tattvam has built a reputation for providing comprehensive financial solutions, with a focus on innovative technology and customer-centric approaches.

Core Services of Tattvam main

Tattvam main offers a diverse array of financial services, designed to meet the varied needs of its clientele. These services are structured to provide maximum value and flexibility to investors:

- Investment Portfolio Management

- Financial Planning and Advisory

- Market Analysis and Research

- Risk Assessment and Mitigation Strategies

Each of these services is tailored to align with individual client goals, ensuring a personalized approach to financial management.

Technological Innovation in Tattvam main

One of the key strengths of Tattvam main lies in its adoption of cutting-edge technology. The company leverages advanced algorithms and data analytics to provide accurate market insights and investment recommendations.

| Technology | Application | Benefit |

|---|---|---|

| AI-driven Analytics | Market Prediction | Enhanced Accuracy |

| Blockchain | Secure Transactions | Increased Security |

| Machine Learning | Risk Assessment | Improved Risk Management |

This technological edge allows Tattvam to stay ahead of market trends and provide timely, data-driven advice to its clients.

Investment Strategies at Tattvam main

Tattvam main employs a range of investment strategies, each designed to cater to different risk appetites and financial goals. These strategies are continually refined based on market conditions and client feedback:

- Value Investing

- Growth Investing

- Income Investing

- Contrarian Investing

The diversity in strategies allows Tattvam to create balanced portfolios that can weather various market conditions.

Explore StrategiesRisk Management Approach

Risk management is a critical component of Tattvam main's operational philosophy. The company employs a multi-faceted approach to mitigate potential risks:

| Risk Type | Management Strategy |

|---|---|

| Market Risk | Diversification across asset classes |

| Credit Risk | Thorough due diligence on investments |

| Operational Risk | Robust internal control systems |

| Liquidity Risk | Maintaining optimal cash reserves |

This comprehensive risk management framework ensures that client investments are protected against various market uncertainties.

Client Education and Support

Tattvam main places a strong emphasis on client education and support. The company offers:

- Regular market updates and newsletters

- Webinars and workshops on financial topics

- One-on-one consultation sessions

- Online resources and educational materials

These initiatives help clients make informed decisions and stay updated on market trends.

Regulatory Compliance and Ethics

Tattvam main operates under strict regulatory compliance, adhering to all applicable financial regulations. The company's ethical practices include:

| Ethical Principle | Implementation |

|---|---|

| Transparency | Clear disclosure of fees and terms |

| Confidentiality | Robust data protection measures |

| Integrity | Adherence to professional standards |

| Fairness | Equitable treatment of all clients |

This commitment to ethical practices has helped Tattvam build trust and credibility in the financial sector.

Global Reach and Local Expertise

While Tattvam main operates on a global scale, it maintains a focus on local market expertise. This approach allows the company to:

- Understand nuanced market dynamics in different regions

- Provide culturally sensitive financial advice

- Navigate local regulatory environments effectively

- Offer customized solutions for specific market needs

This balance between global reach and local expertise positions Tattvam main as a versatile financial partner for diverse clientele.

Global ServicesConclusion

Tattvam main has established itself as a forward-thinking player in the financial services industry. Through its innovative use of technology, comprehensive range of services, and commitment to client education and support, Tattvam has created a robust platform for financial growth and stability. The company's adherence to ethical practices and regulatory compliance, combined with its global reach and local expertise, makes it a reliable partner for individuals and institutions seeking professional financial management. As the financial landscape continues to evolve, Tattvam main is well-positioned to adapt and provide valuable services to its diverse client base.

FAQ

What sets Tattvam main apart from other financial service providers?

Tattvam main distinguishes itself through its innovative use of technology, comprehensive range of services, and strong focus on client education and support. The company's blend of global reach with local expertise, along with its commitment to ethical practices and regulatory compliance, makes it a unique player in the financial services sector.

How does Tattvam main manage investment risks?

Tattvam main employs a multi-faceted risk management approach. This includes diversification across asset classes to mitigate market risk, thorough due diligence on investments to manage credit risk, robust internal control systems for operational risk, and maintaining optimal cash reserves to address liquidity risk. The company also uses advanced analytics and AI-driven tools to assess and predict potential risks.

What types of investment strategies does Tattvam main offer?

Tattvam main offers a range of investment strategies to cater to different risk appetites and financial goals. These include value investing, growth investing, income investing, and contrarian investing. The company continuously refines these strategies based on market conditions and client feedback, allowing for the creation of balanced portfolios that can adapt to various market scenarios.